Table of Content

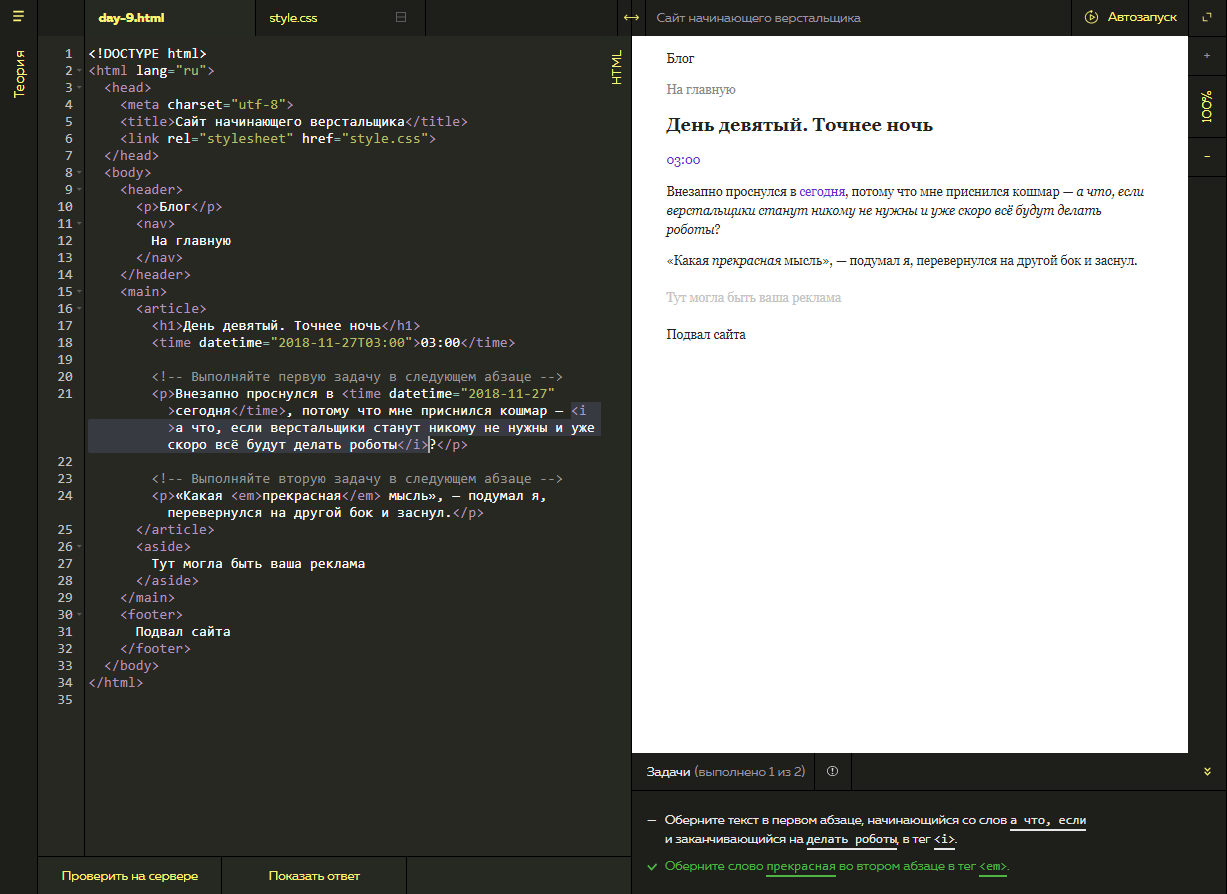

Comparing home equity lenders by their rates and fees can be challenging. This is because every lender offers different products. Moreover, lenders operate in different states, and thus are subject to different laws and regulations. As a result, an apples-to-apples comparison of fee and rate structures can be difficult. In general, the rates TD Bank charges were slightly less than other lenders. Available on 1–4 family primary or secondary residences, excluding mobile homes, boats, RVs, and homes for sale, under construction or on leased land.

They have been debating on whether they would move to expand their living space, or finish their basement. In the end, they decide to stay in their neighbourhood and take on the basement renovation. So they apply for a line of credit secured by their home for the maximum amount they qualify for, $100,000 at TD Prime Rate + 0.50%.

What do TD Bank’s customers say about the company?

By using the total amount towards the basement renovation and paying back $10,000 within the first six months, they had enough credit available for a trip to visit their daughter overseas. If it’s approved, you’ll get a document with the final loan details to review before closing. If you have a balance at the end of 10 years, you have another 20 years to repay the remaining principal with interest. You can no longer borrow from the line of credit during this time. For both the financing is secured by your home, so your interest rate may be lower than other types of loans.

In-person signing required, even if you applied online. If you’re not sure about an answer — or if you’re applying with someone else and don’t have all of their information — just give us your best estimate. Third-party sites may have different Privacy and Security policies than TD Bank US Holding Company.

Home equity line of credit (HELOC)

TD Bank Home Equity Line of Credit will typically fund home equity lines of credit in as few as 30 days of approval. Maybe you want to add value to your home by making home improvements. Find out what information and documents you’ll need to apply for your home equity loan or line of credit. You can reach TD Bank if you need assistance with your home equity account or want to apply for a new one. Paying off the balance and keeping the line of credit open. Choose a HELOC or home equity loan, and note your primary purpose for the loan.

See if you qualify for student loan refinancing and compare real time offers. The home equity loans and lines of credit offered by TD Bank offer a number of unique features. While there were some issues with the online services, customer service on the whole was good, making TD Bank a good place to look for a home equity loan or line of credit.

TD Bank Home Equity Line of Credit

Common issues relate to in-branch customer service and difficulty getting help with accounts over the phone. TD Bank’s BBB rating is an A, and it is an accredited lender through the agency. However, the 313 listed customer complaints give the bank a rating of 1.03 out of 5 stars. Customer complaints also include issues with general bank services, such as checking and savings accounts, not just home equity products.

TD Bank requires you to enter your Social Security number before submitting your home equity loan application. After a “hard” credit check, TD Bank will determine your eligibility and the terms it will offer. It doesn’t offer prequalification with a “soft” credit check. Answer a few more disclosure questions regarding your finances and the property. Once that’s complete, you can review your answers and make any changes. This section will also ask about your homeowners insurance, whether you collect rental income on the property, and how much, if any, you owe to your current mortgage lender.

Therefore you should make sure there is a branch near you or you will find yourself spending a long drive to close your loan. Many other lenders don’t offer this service, making TD Bank one of the only providers if you are looking to use a second home or rental property for your home equity financial product. However, TD Bank is more likely to charge various administrative fees than other lenders. Specifically, TD Bank is more prone to charging application fees, closing costs, and early payoff fees. Member FDIC TD Bank, N.A. Loans subject to credit approval. TD Bank does not offer closed-end loans (i.e. Home Equity Loans) for the purpose of post-secondary education financing.

You can borrow $10,000 or more against your primary or secondary home with a TD Bank home equity loan. These loans offer a repayment period of five to 30 years with fixed interest rates. TD Bank is a regional institution that offers bank accounts, personal loans, home mortgages, investment products, credit cards, and home equity products. With roots dating back to 1855, TD Bank’s proper entrance into the U.S. banking market began in 2005 when it acquired Banknorth. Remember the APRs of HELOCs do not include points and financing charges, just the interest rate. Most home equity lines of credit have a variable interest rate.

Home equity is the market value of a home, minus any outstanding debt secured by or charges on the property. Choose from a variety of both fixed and variable rate options. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any financial institution. This editorial content is not provided by any financial institution.

No other lender we reviewed offers this particular product. Evaluating eligibility requirements is another difficult task when comparing different home equity lenders. The most effective means of doing so is to establish a matrix of different values to get a complete understanding of the scope of the different products they offer. Some of the best metrics include debt-to-income ratio, maximum loan-to-value, minimum credit score, and equity requirements. TD Bank has more than 1,500 customer reviews through Trustpilot, rating 1.3 out of 5 stars. Like TD Bank’s BBB ratings, Trustpilot consumers have commented on and reviewed the bank for many products and services.

TD Bank will automatically populate the estimated loan amount available. In our case, it showed an estimated maximum CLTV of 75%, though this may vary based on your home value, location, and creditworthiness. With a TD Bank HELOC, homeowners can open a line of credit against the equity in their primary or secondary home. This HELOC can range from $25,000 to $500,000 with no minimum draw requirement.

No comments:

Post a Comment